Irs Standard Deduction For Tax Year 2025. The standard deduction for people who are married filing jointly will go up $1,500 for the 2025 tax year, up from $27,700 to $29,200. People 65 or older may be eligible for a.

A deduction reduces the amount of a taxpayer’s income that’s subject to tax, generally reducing the amount of tax the individual may have to pay. In tax year 2025, the standard deductions are as follows:

Irs Standard Deduction 2025 Betta Donielle, The irs on thursday released updated tax brackets and standard deductions for 2025.

Irs 2025 Standard Deduction For Seniors Brier Carissa, For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2025, an increase of $750 from 2025;

Tax Brackets And Standard Deductions 2025 Nissa Carmelina, For heads of household, the standard.

Irs Standard Deduction 2025 Single Brynne Arluene, For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2025, up $750.

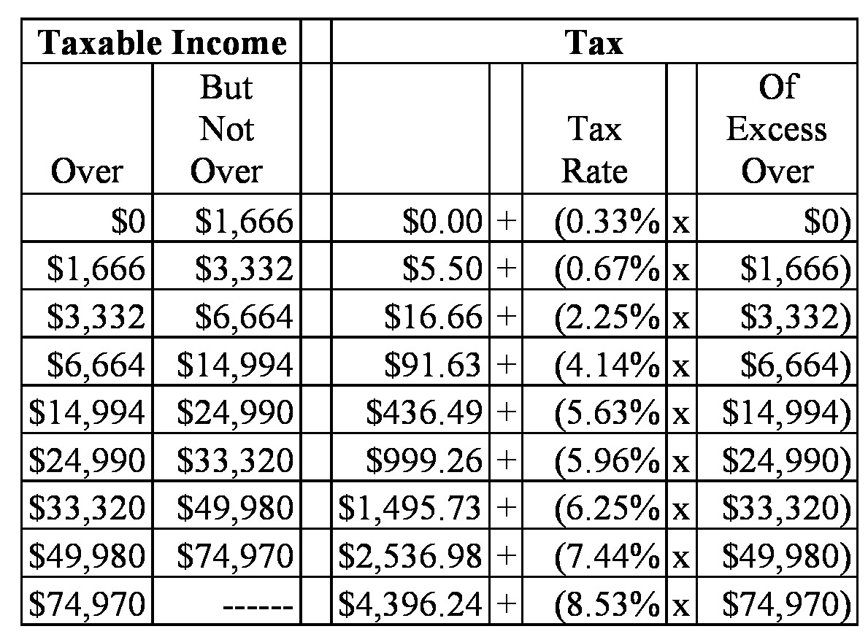

Tax Brackets 2025 Married Jointly Irs Standard Deduction Gray Phylys, Table 1 shows the filing requirements for most.

2025 Tax Tables And Standard Deduction Amara Bethena, In tax year 2025, the standard deductions are as follows:

2025 Irs Tax Brackets And Standard Deduction Deva Silvie, Standard deduction and personal exemption.

IRS Standard Deduction 2025 What is it and All You Need to Know about, The standard deduction will increase by $750 for single filers and by $1,500 for joint filers (table 2).